WWW.WA

S.ORG

WWW.WA

S.ORG

•

WORLD AQUACULTURE

•

DECEMBER 2014

29

T

he continuous decline

in eel production from wild

capture fisheries has become

a formidable issue globally.

Most eel populations have

already been declared to be

threatened or close to extinction.

However, eel demand for

human consumption continues

to grow, particularly in Asia.

Consequently, because of

limited glass eel supply from

the wild and unsuccessful

commercial glass eel production

technology, the glass eel price

has surged to a historic high.

As a result, eel production has

become one of the most difficult

and challenging aquaculture

industries in the world.

Despite three decades of

phenomenal research advances,

the scientific community

has not been able to develop

the complete package for eel

farming on a commercial scale.

At present, Japan is the only

country to have developed

a complete eel production

technology but the production of

seedlings is insufficient to meet

international demand.

Eel Aquaculture

in Korea

In Korea, Pukyong

National University initiated

research on the Japanese eel

Anguilla japonica

in 2002

and achieved success in fertilizing eggs. In 2006, a majority of

the eel research moved to the country’s largest fisheries research

institution, the National Fisheries Research & Development

Institute (NFRDI). Subsequently Korea’s government policy was

targeted to develop complete aquafarming technology for eel in the

near future. After a decade of research efforts, Korea has finally

Dietary Requirements for Ascorbic Acid,

α

-Tocopheryl Acetate and

Arachidonic Acid in Japanese Eel,

Anguilla japonica

Sungchul C. Bai, Kumar Katya and Hyeonho Yun

produced two individual glass

eels for aquaculture. Korea

should soon have a complete

aquafarming package for eels

and begin to play a greater role

in global eel production (Bai

et. al

. 2012).

Not surprisingly, despite

the lack of a comprehensive

technical package for eel

aquafarming and complete

dependence on nature for glass

eels, aquaculture production

has developed impressively

in Korea. Japanese eel

production accounts for

27 percent of freshwater

aquaculture in Korea, due

to historical high demand in

domestic and international

markets, especially in Japan.

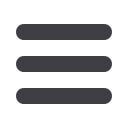

Production of eel increased

from a negligible value of 500

t in 1980 to 4,257 t in 2012

(Fig. 1). However, aquaculture

production of eels peaked in

2010 and then declined in the

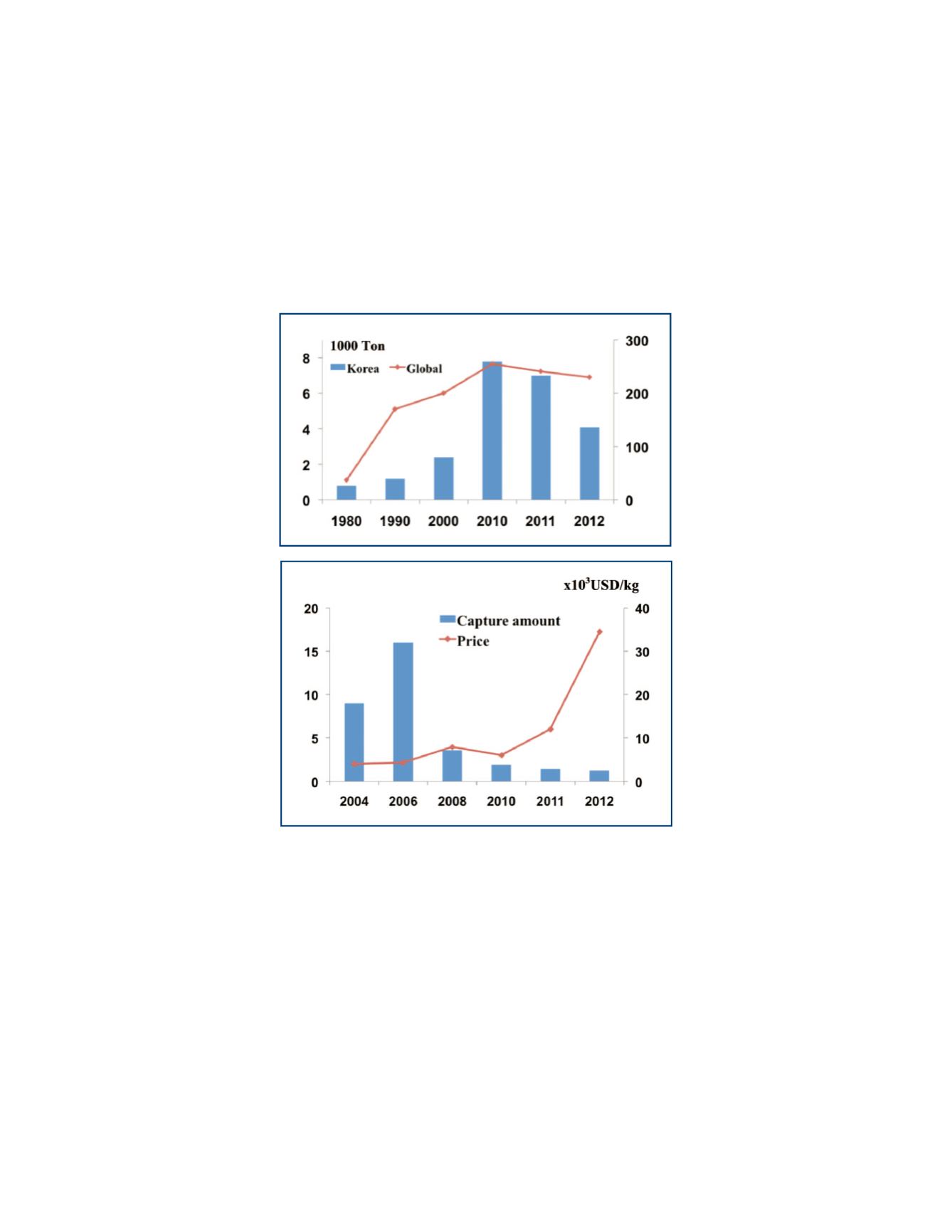

next two years. Every year, 10

to 20 t of 0.2-g wild captured

glass eel are stocked and

grown to 200-g marketable

size within one year. However,

in 2012, only 2 t of glass eel

were captured domestically

and 7-8 t were imported

from different countries.

The current market price for

glass eels is around $7 per

individual ($35,000/kg) while

market-size eel fetches a premium price of around $50-70/kg at the

farm gate (Fig. 2, Bai

et. al

. 2012).

Favorable government support that spurred research and

the growing experience of farmers based on trial and error have

established a strong foundation for eel aquaculture. Consistent

TOP, FIGURE 1.

Eel production trend in Korea and the world.

BOTTOM,

FIGURE 2.

Trend in glass eel capture and price.

The continuous decline in eel production

from wild capture fisheries has become

a formidable issue globally. Most eel

populations have already been declared to

be threatened or close to extinction.

However, eel demand for human consumption

continues to grow, particularly in Asia.

( C O N T I N U E D O N P A G E 3 0 )