A WELFARE ANALYSIS OF NORWAY’S EXPORT PROMOTION PROGRAM FOR WHITEFISH

Farm groups have a long history of supporting generic advertising and other activities designed to strengthen the demand for their products in domestic and foreign markets (Forker and Ward, 1993). A large empirical literature has developed on the costs and benefits of these programs (for examples see Piggott et al. 1995, Kaiser et al. (2005), and Kinnucan and Cai (2011); for a review, see Williams et al. (2018)). This study contributes to the literature of generic advertising in two ways. First, using Norway’s export promotion program for whitefish as a case study we show that the benefit-cost ratio (BCR) from the producer perspective, defined as the increase in producer surplus associated with the advertising divided by the decrease in producer surplus associated with the levy used to finance the advertising, is invariant to the supply elasticity. This result is implied by Kinnucan and Myrland’s (2000) analysis of the optimal levy and is demonstrated in empirical studies by Alston et al. (1998, 2005). Nonetheless, it has been largely ignored in the BCR literature. An important implication of the invariance property is that the BCR can be approximated using strictly demand-side information. If the goal is to obtain an estimate of the producer benefits of the advertising in relation to producer costs, estimates of the own-price and advertising elasticities of demand suffice; there is no need to estimate the supply side of the market. Second, we show that the BCR from the consumer perspective, defined as the increase in consumer surplus associated with the advertising divided by the decrease in consumer surplus associated with the levy, is identical to the BCR from the producer perspective , which is new. Our study considers Norwegian whitefish as a case study.

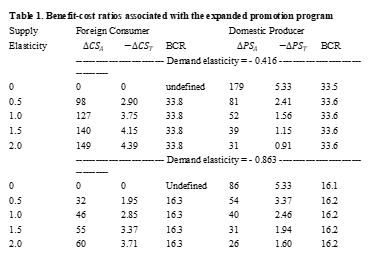

Norway recently increased the levy used to fund its export promotion program for whitefish from 0.50% to 0.75%. Study results suggest the intensified program is welfare increasing. The net social gain, defined as difference between the increase in economic surplus associated with the increased advertising and the decrease in economic surplus associated with the increased levy, is estimated at between $81 million and $174 million per year. The associated benefit-cost ratio (BCR), defined as the ratio of the aforementioned changes in economic surplus, is between 16 and 34 (Table 1) . The BCR is invariant to the supply elasticity. The invariance property is useful as it implies the BCR can be estimated using strictly demand-side information; there is no need to estimate the supply side of the market. This result is generalizable to any advertising program funded by a levy on industry output or sales.