STOCHASTIC MODELING AND FINANCIAL VIABILITY OF MOLLUSK AQUACULTURE

Due to the limited control with the production process in mollusk farming, understanding the risks associated with production can be critical to a farm's success. Despite the industry's need for more knowledge, compared to freshwater finfish and crustaceans, limited attention has been given to economic aspects of mollusk production, such as productivity growth and production risk. Research that has been conducted on the economic viability of molluscan aquaculture often employed deterministic profitability models with sensitivity analysis used to measure risk. However, deterministic sensitivity analysis assumes variables are well known and can be represented by a single value, which can be inaccurate if inputs are highly correlated. Due to the characteristics of mollusk farming, it could be better fit by models that are a function of multiple random elements. Stochastic risk analysis can be performed utilizing Monte Carlo simulation in conjunction with sensitivity analysis or simulation scenarios can be compared. We applied both methods to compare three different environmental scenarios, three equipment systems, and four risk mitigation strategies for Gulf of Mexico oyster production.

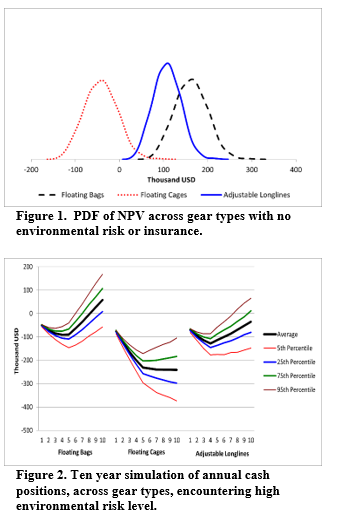

For our Gulf of Mexico case study, results showed that when no environmental risk was included, all three gear systems were profitable on an annual basis by the end of the 10-year time frame. The floating bag system had the highest average NPV (figure 1). When environmental events were introduced to the simulations, there was a predictable negative correlation between profit and the likelihood of environmental events. Floating cages were most adversely affected by these occurrences and had zero instances of a positive cash position by year 10 (figure 2). When risk mitigation strategies were introduced in the form of crop insurance, the economic difference between the four strategies were small. No insurance level had first order stochastic dominance.

As shown in our Gulf of Mexico example, differences in local environmental characteristics and production systems used can greatly influence profitability. For future applications of the model, we must be cognizant of the unique challenges to each region being analyzed and the species being farmed.